Auto Enrollment for UK Pensions

THE UK PENSION LANDSCAPE

In the UK, all employers must have a qualifying pension plan set up to be compliant with the Auto-Enrollment legislation at or before a specified deadline known as the “staging date”. A company’s staging date is determined by its PAYE registration number, but the UK Government also issued the below (revised) indicative implementation timetable:

| Employer size (by PAYE scheme size) or other description | Automatic Enrollment duty date | |

| From | To | |

| 250 or more members | 10/1/12 | 2/1/14 |

| 50 to 249 members | 4/1/14 | 4/1/15 |

| Test tranche for less than 30 members | 6/1/15 | 6/30/15 |

| 30 to 49 members | 8/1/15 | 10/1/15 |

| Less than 30 members | 1/1/16 | 4/1/17 |

| Employers without PAYE schemes | 4/1/17 | – – – |

| New employers Apr 2012 to Mar 2013 | 5/1/17 | – – – |

| New employers Apr 2013 to Mar 2014 | 7/1/17 | – – – |

| New employers Apr 2014 to Mar 2015 | 8/1/17 | – – – |

| New employers Apr 2015 to Dec 2015 | 10/1/17 | – – – |

| New employers Jan 2016 to Sep 2016 | 11/1/17 | – – – |

| New employers Oct 2016 to Jun 2017 | 1/1/18 | – – – |

| New employers Jul 2017 to Sep 2017 | 2/1/18 | – – – |

| New employers Oct 2017 | Immediate duty | – – – |

Source: https://www.gov.uk/government/news/new-timetable-clarifies-automatic-enrolment-starting-dates

Upon reaching the staging date, automatic enrollment to the organization’s qualifying pension plan is mandatory for all employees who meet the “eligible employee” criteria. Both employer and employee must make contributions into the plan each pay period.

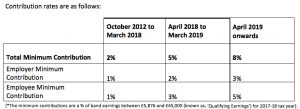

Following “staging” the minimum contributions that need to be made by the employee and the employer into the relevant pension scheme are being phased between 2012 until April 2019.

IMPLEMENTATION CONSIDERATIONS

Any occupational pension plan implemented will need to comply with Auto-Enrollment (AE) regulations from inception.

It is typical practice to set up a Group Personal Pension Plan with an Insurer, however, to do this an employer typically requires a minimum of five employees. With fewer employees, the main option available to meet the legislative requirements is to use a National Employment Savings Trust (NEST). NEST has been set up by the UK Government especially for auto enrollment to make sure that every employer, irrespective of size, has access to a workplace pension scheme that meets the requirements of the new pension rules.

NEST is free for employers to use. It’s excellent value for members too, with one simple charging structure whichever fund they choose. MCN Associates is a registered NEST Delegate Organization, and can set up NEST and manage the scheme on behalf of clients; all the client will be required to do is to register on the NEST website and agree to their Terms and Conditions.

For employers with more than five employees there are a number of considerations:

- Insurers will need to assess what return they will receive from employees’ investments and do have the right to decline a pension scheme if they do not wish to accept an Many providers will only accept new pension schemes if there are employer and employer contributions above the minimum contribution levels set for auto-enrollment.

- Due to the heavy regulations surrounding the UK pensions and financial institutions, all pension schemes must be implemented by an advisor who is authorized and regulated by the Financial Conduct Authority (FCA).

- Fees are associated with financial advisors setting up the pension scheme. MCN work with a trusted and regulated pension advisor and have negotiated fees below the market average.

Contribution considerations:

If no company pension contributions are being funded at the present time, the employer should begin to consider whether they wish to fund the minimum contributions required to meet their legal obligation, or offer higher contributions to match typical competitor organizations in order to attract and retain the best staff. There are a few options for how contributions could be structured. These options would be discussed in detail as part of the implementation process.

Opting Out/Leaving

Everyone who is auto-enrolled can choose to opt out of the scheme within one month of enrollment. If this happens then any money paid into the member’s pot will be refunded. Employers must automatically re-enroll any eligible employees who opt out every three years.

When can the employee take money out?

Funds can be taken out at any point after the employee’s 55th birthday.

What happens to the money if the employee leaves?

Plans are in the employees. own name. Employees can continue to contribute even if their circumstances change, or transfer their funds to another plan.

IMPLEMENTATION PROCESS

It is important to understand the employer’s current situation, company guidelines and plans, company contribution level, contributions by salary sacrifice, sharing of NI savings considerations, etc. before a market review is conducted with reputable insurers; and an advice report drawn up to provide guidance on which provider best suits the company requirements.

When the decision on provider has been determined, a communication plan should be put in place with a series of compliant communications which must be shared with employees. Completion of the enrollment process requires overall project management of payroll, pensions advisor, pensions regulator, HR and employees. This can be an extremely time consuming process and requires a fair degree of understanding of how the different parties feed into the process, the compliance issues and the relevant timelines. The communications plan is heavily influenced by the compliance requirements in ultimately ensuring that employees understand their choices and these are carried out accordingly.

PLAN AHEAD

Any employers who have not yet put in place their Workplace Pension should begin planning soon as the process can take three months or more to complete.

MCN Associates is a UK based International HR business that exclusively assists US Corporates expanding overseas. Our team of experienced HR practitioners support and advise on all Core HR, Employee Compensation & Benefits and Immigration related matters in over 60 countries. For the past 18 years, the consultants at MCN have built an impressive network of more than 150 local HR consultants, benefits brokers, and legal professionals available to provide additional in-country support as and when required. For further information, please contact:

Chris Davies